About

Beacon Financial Services is a fintech firm that provides cashflow advisory and working capital solutions to SME owners in Singapore. Combined with the team’s deep experience in capital financing, they leverage their proprietary technology and algorithm to help SMEs get the funding they need with speed and certainty.

At its core, Beacon Financial Services provides the necessary tools for businesses to succeed. By assessing a business’ goals and cash flow needs, they help them make more informed and confident business decisions about their funding options and create a roadmap for success.

Challenge

The firm’s main clientele are SMEs seeking working capital funding — many of which struggle with having sufficient cash flow to make payments on time. As such, the firm often faces delayed payments of up to 60 days, which in return, greatly affects the firm’s ability to maintain their own cash flow and make payments on time.

Hence, they needed an alternative solution to gain greater control of their cash flow. At the same time, rather than spending time chasing for payments, the firm wanted to focus the time on growing the firm and helping more businesses.

Solution

CardUp provided an all-in-one solution for their payment and collection needs. Without the need for any technical integration, the firm can now offer its clients the option to pay using their existing credit card.

Their team found that accepting credit card payments has highly incentivised their clients to pay on time as they now leverage on their credit line to access interest-free credit and earn rewards on these payments.

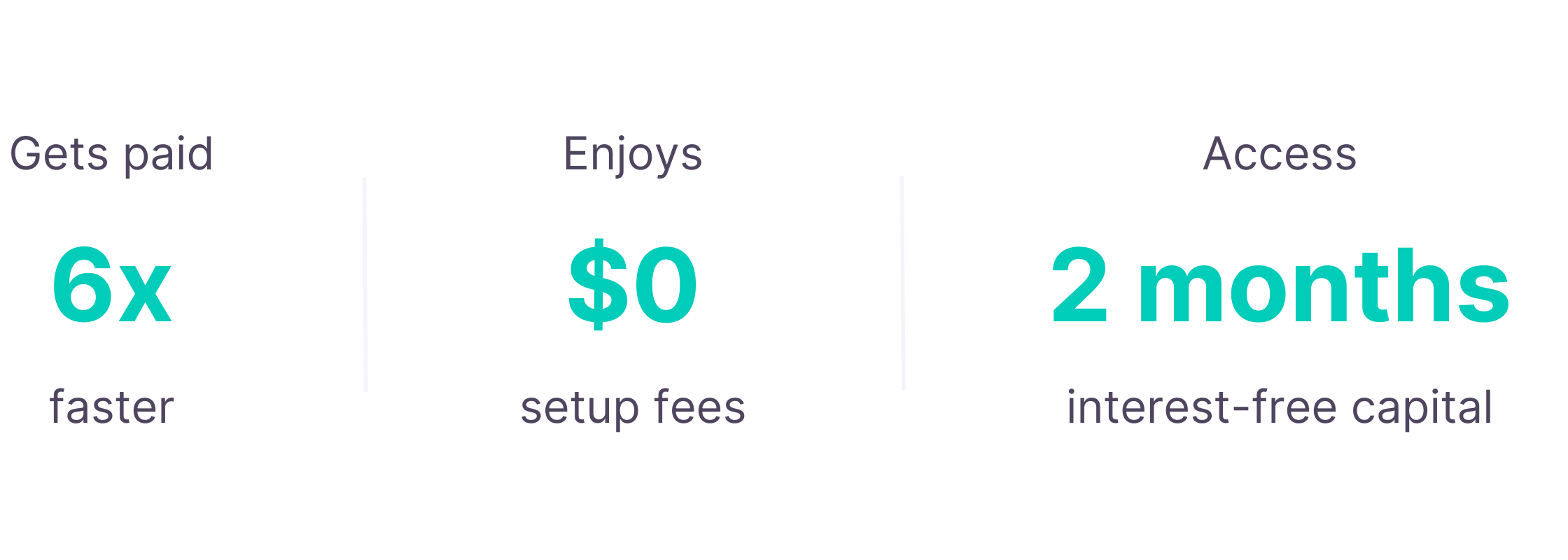

To send payment requests to clients, the Beacon team create digital payment requests on CardUp’s platform and send the requests either via email or SMS. Beacon then receives the payment paid directly into their bank account while their clients enjoy deferring the payment until when their credit card bill is due up to 2 months later. Each payment is automatically tracked and reconciled onto CardUp’s easy-to-use platform.

While enabling their clients to enjoy the benefits of paying with their credit card, the firm also pays their rent and supplier payments using their credit card through CardUp. This allows Beacon to also earn card rewards and free up additional cash.

Outcome

The firm now has stronger control over their cash flow and receivables process.

Get paid 6x faster

Since using CardUp, the firm’s receivables process improved greatly. The firm now gets paid within 10 days. They also no longer spend unnecessary amount of time chasing, verifying, and reconciling payments. More time is now spent on helping businesses and sourcing for growth opportunities.

“Since our clients are incentivised to make the payment to us, we get the money on time, and we can plan our business better. That is how much our payments have improved since using CardUp.”

Higher customer conversion rate

In addition to enabling credit card payments, CardUp helped the firm present a viable solution to clients who require short-term cash flow. The firm has seen a 300% growth in number of clients and higher customer conversion rate since adopting CardUp.

Access cash flow and early payment discounts

Since shifting their rent and supplier invoices onto their credit cards, the firm can now fully access their existing credit line and free up cash—by up to 2 months.

Get started for free

Join Beacon Financial Services and the thousands of businesses who have already started saving precious time and money through CardUp.

.png)

.png)